Industrial Update – Newsletter – August 2025

IMAP’s Industrials group brings you this monthly update with a focus on latest news, transactions and interesting snippets from the Industrials domain in India

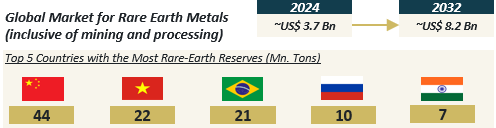

Rare Earth Metals have gained strategic importance as demand surges across industries and governments compete to secure resilient supply chains. Comprising 17 elements—the 15 lanthanides along with scandium and yttrium—these metals exhibit unique magnetic, catalytic, and optical properties essential to over 200 applications, including electric vehicles (EVs), renewable energy systems, advanced defense technologies, and consumer electronics.

Despite their name, “rare” earth elements are relatively abundant in the Earth’s crust. However, their extraction is complex due to their dispersed occurrence and the scarcity of economically viable deposits. This makes their supply chains vulnerable and geopolitically sensitive.

By end use, the largest segment of rare earth elements is magnets (particularly neodymium magnets, which have critical applications). Other key uses include catalysts, polishing agents, batteries and other specialized applications.

Magnets, especially neodymium-iron-boron (NdFeB) magnets, represent the largest end-use segment, critical for EV motors, wind turbine generators and other high-performance applications. Other vital uses include catalysts in petroleum refining, polishing powders, rechargeable batteries, phosphors for lighting among others.

China dominates the rare earth ecosystem, producing ~61% of the world’s rare earth output and controlling ~92% of global processing capacity. This dominance extends to mining, refining and manufacturing giving China a near-monopoly on the supply chain. Recent export restrictions amid trade tensions have significantly disrupted global manufacturing, particularly impacting sectors like India’s EV industry. For e.g. the shortage saw Bajaj Auto’s flagship EV scooter, Chetak halve production from 20,384 units in Jul’23 to 10,824 units in Jul’24.

To tackle the situation, India has launched a ₹34,300 Cr (US$ 4.1 billion) National Critical Minerals Mission to accelerate exploration and development of the downstream capacity (this scheme covers both rare earth elements and other critical materials). Despite mining ~2,900 tons in 2024, India imported 53,748 tons of rare-earth magnets highlighting a huge opportunity. India has also approved a ₹5,000 Cr. (US$ 600 million) incentive scheme for manufacture of magnets.

India, with estimated rare earth oxide reserves of around 7 million tons, is rapidly expanding its refining, recycling, and magnet manufacturing capabilities. Through strategic involvement in the US-led Minerals Security Partnership, India has also attracted multiple co-investment projects to boost supply chain resilience.

Some recent transactions

Recent News

- US tariffs of 50% on goods from India came into effect, expected to impact exports especially of textiles, gems and jewelry, leather, marine products and engineering; to counter the impact India is developing new markets and is also overhauling its key Goods and Service Tax (GST) structure to boost domestic consumption

- India’s GDP had a higher-than-expected growth of 7.8% in the Apr-Jun quarter (China grew 5.2% and US 3.3% during this period); this growth was largely driven by high government capex, frontloading of exports (ahead of tariffs) and service sector growth

- India’s manufacturing PMI rose to the strongest level since 2008 , reaching 59.8 in Aug’25; a number over 50 signifies growth

- Japan plans to invest around US $68 billion in India over the next decade, targeting semiconductors, AI, clean energy and critical minerals alongside talent exchange and digital collaboration initiatives

IMAP Industrials Index & Valuation of sub-segments

Commodity Prices Index

IMAP – International M&A Partners is an independent organization focused purely on M&A and transaction success. With over 450 M&A professionals based in over 43 countries, we work together in seamless cross-border sector teams and address each assignment with talent and dedication. We advise primarily mid-sized companies and their shareholders on the sale and acquisition of companies on a global scale.

Reach out to us to discuss more :

- Praveen Nair : +91-9820330033 / praveen@imapindia.in

- Puneet Kochar : +91-9810287367 / puneet@imapindia.in