Industrial Update – Newsletter – October 2025

IMAP’s Industrials group brings you this monthly update with a focus on latest news, transactions and interesting snippets from the Industrials domain in India

RRefractories are specialized materials designed to withstand extreme temperatures – typically above 500°C without losing strength or chemical integrity. These non-metallic, heat-resistant materials are vital in industries such as steel, cement, glass, power, and petrochemicals, where they line furnaces, kilns, and reactors to protect equipment from intense heat and corrosive environments.

Refractories play a critical role in improving plant uptime, thermal stability, throughput, and service life across sectors. They are typically classified by composition (oxide and non-oxide) and by form (pre-shaped and monolithic, the latter of which can be cast or gunned in-situ). Differentiated products include high-performance refractories – capable of withstanding temperatures up to 1800°C, and specialty refractories engineered for specific industries or enhanced properties.

In India, approximately 70% of refractory demand is driven by the steel industry, with the remainder serving ceramics, glass, chemicals, and other sectors. Refractories are high-spec consumables representing about 2-3% of production costs and required periodic replacement irrespective of steel price cycles.

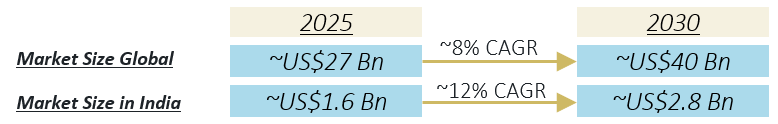

The Indian market consumes around 1.5 million tonnes per annum (MTPA) of refractories, supplied mainly by domestic producers with ~30% met through imports, predominantly from China. For raw materials, India imports over 40% of its requirements (magnesite, alumina, bauxite, quartzite etc) from China.

With planned expansions in steel capacity over the next 5 years, refractory demand is expected to increase substantially, presenting clear growth opportunities. The Indian market includes large global and domestic players (RHI Magnesita, TRL Krosaki, Calderys, Vesuvius, IFGL) alongside mid‑ and small‑sized Indian firms.

The market is at a turning point where specialized refractories are becoming attractive investments. Closed-loop recycling can recover about 70% of material and reduce refractory costs by over 20%, while decreasing dependence on Chinese imports and mitigating supply chain risk. Opportunities also exist in underdeveloped precast systems, enabling innovative manufacturing approaches. Companies with capital can explore toll manufacturing and strategic partnerships to supply global OEMs locally.

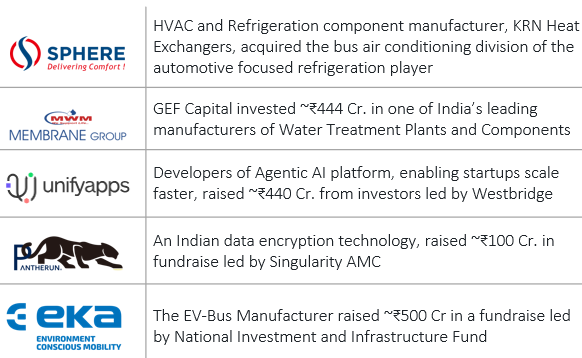

Some recent transactions

Recent News

- Google is committing ~US$15 Bn (over the next 5 years) to establish India’s largest AI hub in Visakhapatnam, marking its single largest investment outside the U.S.

- India’s manufacturing PMI increased to 58.4, signaling a rebound in industrial momentum; readings above 50 indicate expansion.

- Reliance and Meta have formed a JV with a ~US$100 Mn commitment to develop enterprise AI solutions across India

- Nvidia, acquired a ~US$1 Bn equity stake in Finland-based Nokia to advance AI-powered network of 5G-advanced and 6G

- US Fed cut benchmark rate by 25 basis points to 3.75-4.00 %, amid signs of a slowing labour market and continued pressure on prices

- Oct’25 saw the price of gold and silver hit record highs – ₹1,32,294 per 10 grams of gold and ₹1,64,000 per kg. of silver amid a slew of factors driving the same

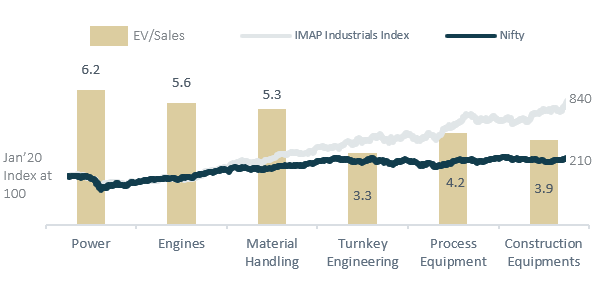

IMAP Industrials Index & Valuation of sub-segments

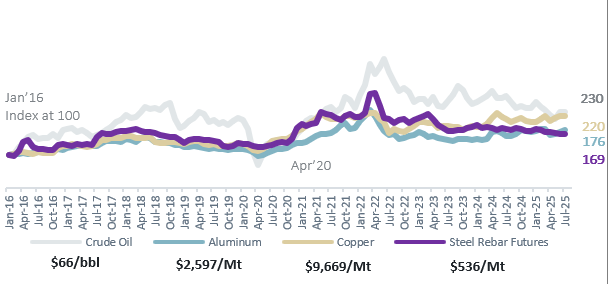

Commodity Prices Index

IMAP – International M&A Partners is an independent organization focused purely on M&A and transaction success. With over 450 M&A professionals based in over 43 countries, we work together in seamless cross-border sector teams and address each assignment with talent and dedication. We advise primarily mid-sized companies and their shareholders on the sale and acquisition of companies on a global scale.

Reach out to us to discuss more :

- Praveen Nair : +91-9820330033 / praveen@imapindia.in

- Puneet Kochar : +91-9810287367 / puneet@imapindia.in