Industrial Update – Newsletter – June 2025

IMAP’s Industrials group brings you this monthly update with a focus on latest news, transactions and interesting snippets from the Industrials domain in India

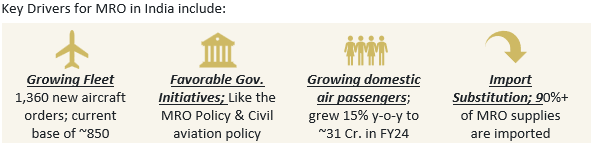

As of 2024, India is the 3rd largest domestic aviation market globally, with an annual airline capacity of ~16Mn seats, and has the world’s 4th largest fleet of military aircraft (~2,300), highlighting the critical need for robust aircraft MRO infrastructure.

Aircraft maintenance can be broken down into on-tarmac checks performed inhouse by the airlines and periodic maintenance ranging from A-level checks (every 350 flight hours) to complex D-level checks (every 6-10 years). A to D-level maintenance is outsourced to MRO service providers.

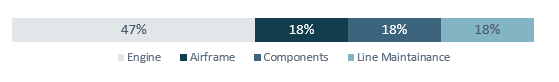

The revenue (US$2.4 billion) breakup by aircraft segment is as follows:

India has a strong advantage in the MRO space; while its costs of maintenance are 25% lower than global MROs, Indian flight operators also save 2-3 days in transit which is a significant saving of potential revenue loss. India MROs currently provide services for A, B and C (part) level maintenance while component manufacturing and the engineering heavy maintenance for engines, landing gear

Iand parts such as thrust reversal (braking), fuel cells and radomes are done abroad. With aircraft volumes in India going up, MROs are expected to scale up with further investments. For e.g. an engine shop could cost US$ 150 million – 200 million to set up which is justified if it is able to service a minimum number of engines (of a type). Defense aviation MRO represents another avenue for expansion.

To help make India “the aviation service center of the world”, GOI launched the MRO policy (tax exemptions, streamlined regulations, focus on domestic manufacturing); and the National Civil Aviation Policy (reducing custom duties from 18% to 5%, financing & tax incentives).

Key Players

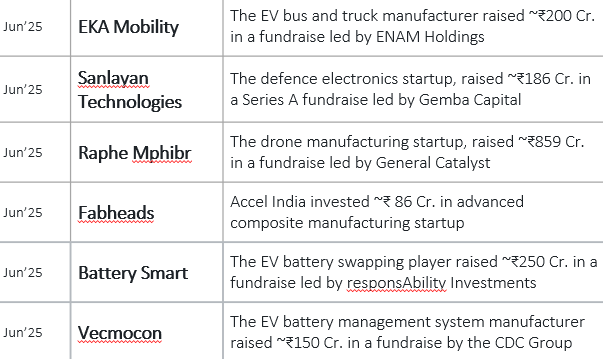

Some recent transactions

Recent News

- The escalation of war in the Middle East saw Brent oil prices increase temporarily to US$ 81 a barrel before falling back to US$66 amid the Iran-Israel truce continuing to hold

- India’s manufacturing PMI rose to 58.4 in June, from 57.6 in May’25 marking the strongest reading since April 2024, fueled by strong new orders and improved global demand

- US Fed maintained interest rates at 4.25%-4.5%, despite pressure from Trump, as it saw a possible inflation spike on the horizon

- After weeks of uncertainty, US and China reached a trade deal in which US tariffs would be set at 55% on Chinese goods while China’s tariffs on US remain at 10%. Additionally, China would be liable to supply rate earth metals and full magnets to US upfront

- JSW paints signed definitive agreements to acquire Akzo Noble India for US$ 1 billion+, making it the 4th largest paint company in India

IMAP Industrials Index & Valuation of sub-segments

Commodity Prices Index

IMAP – International M&A Partners is an independent organization focused purely on M&A and transaction success. With over 450 M&A professionals based in over 43 countries, we work together in seamless cross-border sector teams and address each assignment with talent and dedication. We advise primarily mid-sized companies and their shareholders on the sale and acquisition of companies on a global scale.

Reach out to us to discuss more :

- Praveen Nair : +91-9820330033 / praveen@imapindia.in

- Puneet Kochar : +91-9810287367 / puneet@imapindia.in