Industrial Update – Newsletter – September 2025

IMAP’s Industrials group brings you this monthly update with a focus on latest news, transactions and interesting snippets from the Industrials domain in India

India’s furniture industry, valued at ~US$30 Bn in 2025, is ranked 5th globally in production. Within this value chain, decorative laminates represent a critical surfacing material – these are thin materials applied to surfaces for aesthetics. Made by impregnating kraft paper with thermosetting resins and bonding it under heat and pressure into abrasion-resistant sheets. Commonly used in furniture, cabinetry, wall panels, and countertops, laminates enhance interior design by providing attractive finishes. Laminates can be classified into high-pressure laminates (more durable), and low-pressure laminates, commonly used in furniture.

While the Indian laminate industry has 150–160 participants, 60% of the domestic market is organized, with the top 2 players; Greenlam & Marino alone accounting for ~40%. Indian laminate players are expected to grow at 6 – 7%, driven by growth in real estate and the home improvement segments, increased urbanization, rising

A breakdown of the Indian decorative laminates market; (As of 2023-24)

disposable incomes, and growing consumer demand for aesthetic interior designs and with growth in exports.

The market for decorative laminates is competitive – with organized players facing pressure from the smaller local players, who control ~65% of installed capacity (though 40% of the market demand). Further, substitution risks from other surfacing solutions (veneers, pre-laminates, etc.) exist, given their interchangeability in decorative applications.

At the same time, evolving demand patterns are creating white spaces for new entrants. The shift of consumer demand (as also seen in growth of online platforms for interior design and home renovation) signals premiumization opportunities beyond commoditized decorative finishes. India’s export base also remains underpenetrated, suggesting scope to leverage cost competitiveness and expand into international markets. Additionally, value-added integration into adjacent surfacing categories can mitigate substitution risk and enable bundled solutions for OEMs and retailers, positioning players to capture both volume and margin upside.

Some recent transactions

Recent News

- In a significant step, GOI launched a ~₹7,280 Cr. scheme to build domestic capacity for rare-earth permanent magnets, a core input for EVs, renewables, aerospace and defence. The programme targets to carve out a 6,000 MTPA domestic capacity, to reduce import reliance and strengthening downstream OEM supply chains.

- Digital Connexion, the Reliance and L&T JV, announced a US$11 Bn investment to develop 1 GW of AI-oriented data-centre capacity in Andhra Pradesh, supporting hyperscaler demand and expanding India’s compute infrastructure.

- India’s GDP expanded 8.2% in Q2 FY26 (July–September), marking the fastest quarterly growth in 6 quarters and surpassing consensus estimates of ~7.3%

- Manufacturing PMI in India decreased to 56.60 points in November from 59.20 points in October of 2025. A figure >50 Signifies growth

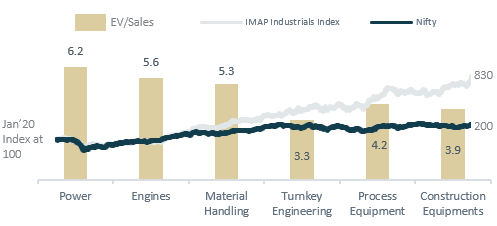

IMAP Industrials Index & Valuation of sub-segments

Commodity Prices Index

IMAP – International M&A Partners is an independent organization focused purely on M&A and transaction success. With over 450 M&A professionals based in over 43 countries, we work together in seamless cross-border sector teams and address each assignment with talent and dedication. We advise primarily mid-sized companies and their shareholders on the sale and acquisition of companies on a global scale.

Reach out to us to discuss more :

- Praveen Nair : +91-9820330033 / praveen@imapindia.in

- Puneet Kochar : +91-9810287367 / puneet@imapindia.in