Industrial Update – Newsletter – November 2025

IMAP’s Industrials group brings you this monthly update with a focus on latest news, transactions and interesting snippets from the Industrials domain in India

Pre-Engineered Buildings (PEBs) are structures that are designed and manufactured in a factory setting before being assembled on-site. PEBs offer significant benefits through their customization for various applications, cost and time effectiveness from off-site manufacturing, durability with high-quality materials and energy efficiency. They are mainly used to build warehouses, manufacturing facilities, commercial buildings, cold-chain facilities among others. The product suite for PEBs typically include structural frames, roofing and walling systems, doors & windows, insulation, foundational systems among others.

Demand is led by industrial and manufacturing (~50% of the market), supported by ongoing capacity additions across sectors, followed by infrastructure (~40%), where speed and standardization are critical. Building applications (~10%) are gradually rising as developers adopt steel-intensive formats for better lifecycle economics and faster commissioning. While the market remains fragmented, organized players accounting for 40% in FY25, are expected to increase share to 50-55% by FY30. PEB solutions offer clear benefits: 5–35% cost advantage in industrial and warehouse projects, 40–50% reduction in execution timelines and ~25% lower onsite labor versus conventional construction methods.

The Top-7 players (Kirby, Interarch, EPack, Pennar, M&B, Everest and Zamil) grew at a avg. revenue CAGR ~10%, with some players growing at ~15%, and are backed by healthy orderbooks (e.g. Interarch:~₹16.5 Bn and Epack:~₹9.17 Bn). Export momentum is also improving, with PEB exports rising from ₹35.8 Bn in FY19 to ₹90.5 Bn in FY25 supported by better fabrication standards and competitive cost structure.

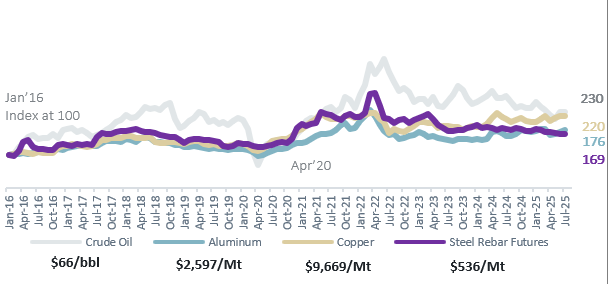

Operational advancements in the Indian PEB sector involve the use of advanced design software such as Building Information Modeling (BIM), automated fabrication using CNC machines, and higher emphasis on sustainable construction. While steel is the primary cost factor, its price volatility creates challenges for PEB companies in transferring costs to customers, prompting the industry to implement strategies like bulk purchasing and long-term contracts to manage these fluctuations.

In conclusion, India’s PEB industry showcases significant versatility, ranging from basic industrial plants to complex facilities, bolstered by government initiatives like the PLI schemes that promote manufacturing growth. With the growth in India GDP and overall manufacturing sector, the PEB industry is set to play a crucial role in India’s transformation.

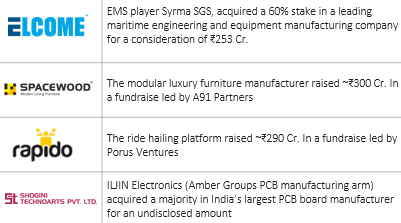

Some recent transactions

Recent News

- The Indian government launched a ₹7,280 crore scheme to build domestic capacity for rare-earth permanent magnets (REPMs), aiming to produce 6,000 MTPA to reduce import dependence

- India’s GDP grew by 8.2% in Q2 FY26 (Jul–Sep), the fastest quarterly increase in six quarters, fueled by GST rate rationalization, preemptive exports ahead of US tariffs and strong festive demand

- Manufacturing PMI in India decreased to 56.6 points in Nov’25 from 59.2 points in Oct’25. A figure greater than 50 signifies growth

- In 2025, US companies announced over 1 million job cuts (65% increase from last year), due to cost-cutting, AI adoption, and reduced consumer spending, with October alone seeing 153,074 layoffs

- Digital Connexion, a JV between RIL, Brookfield and Digital Reality, announced a US$11 Bn investment to develop 1 GW of data-centrecapacity in Andhra Pradesh, India

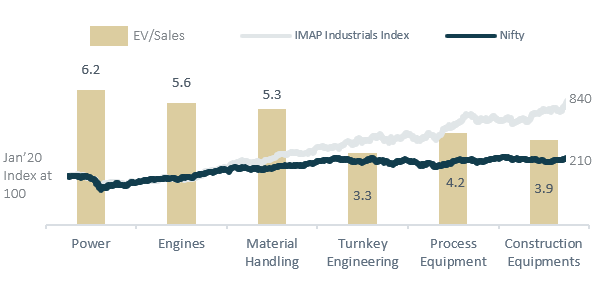

IMAP Industrials Index & Valuation of sub-segments

Commodity Prices Index

IMAP – International M&A Partners is an independent organization focused purely on M&A and transaction success. With over 450 M&A professionals based in over 43 countries, we work together in seamless cross-border sector teams and address each assignment with talent and dedication. We advise primarily mid-sized companies and their shareholders on the sale and acquisition of companies on a global scale.

Reach out to us to discuss more :

- Praveen Nair : +91-9820330033 / praveen@imapindia.in

- Puneet Kochar : +91-9810287367 / puneet@imapindia.in