IMAP is pleased to shared our annual review for 2023 and outlook for 2024.

IMAP partners around the world registered another solid performance, closing 231 M&A deals worth more than $9 billion

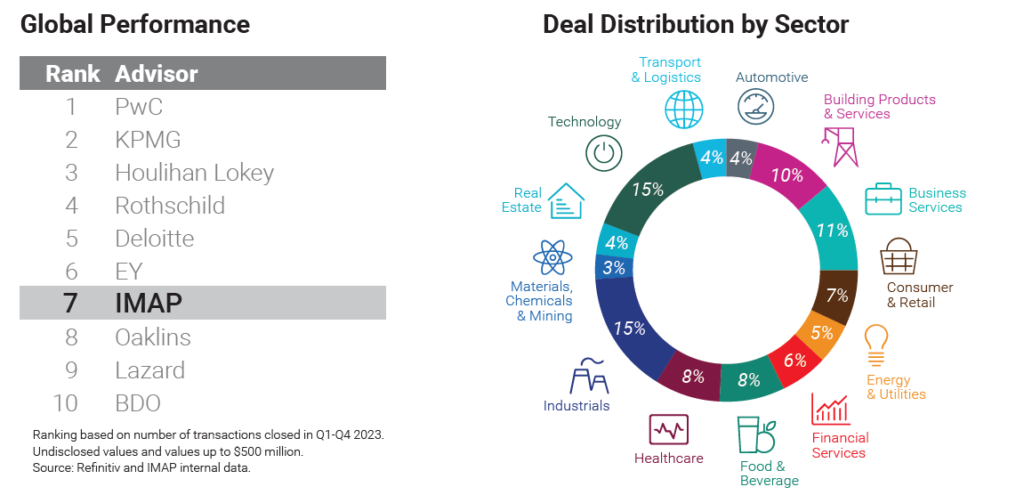

In 2023, despite facing ongoing challenges and uncertainty in the global economic landscape, there was a notable strengthening in the pace of middle-market deal activity. During the latter part of the year, concerns about a recession diminished. While there was an overall decline in global M&A activity in 2023, the middle-market consistently outperformed the broader market. IMAP partners worldwide demonstrated a robust performance by successfully concluding 231 M&A deals, amounting to a total value exceeding $9 billion.

A significant aspect of IMAP’s transactions in 2023 was their international character, with one-third being cross-border deals. This reflects the continued utilization of IMAP dealmakers’ global reach to assist clients in capitalizing on opportunities abroad. In terms of sectors, IMAP was particularly active in Services, Technology, Industrials, and Consumer segments.

“2023 was another surprisingly strong year for middle-market transactions and we start 2024 with a sense of cautious optimism. Underlying market drivers – succession and high levels of PE capital – remain intact. Despite a stubborn inflationary environment, our partners across the globe continue to report strong pipelines and will creatively guide business owners through transactions in changing and unstable economic conditions.”

Jurgis Oniunas, IMAP Chairman

By the end of 2023, strong buyer demand for quality assets increased, fueled by easing inflation and normalized interest rates. Succession planning, horizontal consolidation, and owners seeking liquidity were major drivers of transactions. Financing interest from banks and debt funds revived, albeit with continued scrutiny on business models. Mismatched valuation expectations hindered deals, leading to creative earn-out solutions. Private Equity (PE) involvement persisted, but PE firms approached M&A cautiously. Lower valuations delayed exits on the sell-side, while higher interest rates prompted a pause in acquisitions on the buy-side.

Unspent private capital and robust public company balance sheets may drive increased transaction activity in 2024, with IMAP advisors reporting substantial deal pipelines.

For India, here is what our CEO Ashutosh Maheshvari has to say:

“We are focused on the Industrials and Consumer sectors in India. Over the last couple of years, post-COVID, government spending has had a buoyant influence on these two sectors. From a global perspective, the rising interest rate environment and pressure on public market valuations are having a negative impact on dealmaking and we are wary of that. In the Indian market, there are three predominant factors triggering M&A activity. The first is PE exits, with many of those who invested in the last five to 10 years now reaching the end of a cycle. The second is succession, with the journey of entrepreneurs now reaching a changing point. And third, the acquisition of technology and competences is driving interest among larger players. In addition, there are two big trends in the market that are influencing in particular our strategic thinking as a firm as we present opportunities to our clients. First, there is a big valuation arbitrage between the private and the public market and second, there is significant inbound interest from the global arena in entering Indian markets.”