Industrial Update – Newsletter – December 2023

IMAP’s Industrials group brings you this monthly update with a focus on latest news, transactions and interesting snippets from the Industrials domain in India

India’s Façade & Fenestration Market – A US$ 5.4bn dollar opportunity!

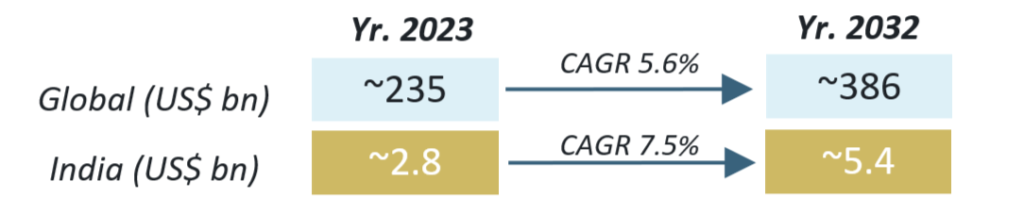

The Indian façade market is valued at US$ 2.8bn in 2023 and is expected to reach US$ 5.4bn by 2032.

While glass wrapping the exterior of the building is a glass façade, there are different types of facades and framing systems – Curtain Wall (non-load bearing curtain-like structures attached to the floor of the building), Unitized Curtain Wall (pre-assembled panels transported to the construction site for installation), Spider Glass Systems (glass panels connected to the structure using point-fixing technology giving frameless appearance), Structural Glazing (glass fixed to the structure using silicone sealants), Double Skin Facades, Finned Glass Façade. While fenestration refers to the arrangement of definite/planned openings in a building such as windows, doors, louvers, vents, wall panels, skylights, etc.

Each type has its advantages in terms of aesthetics, structural support, energy efficiency, and architectural design and are chosen based on specific project requirements and desired visual effect.

The façade market in India is seeing strong growth driven by rapid urbanization, surge in commercial real estate and infrastructure, the rise of green buildings, and increasing exports of design and manufacturing services especially to countries like USA, Japan, and the Middle East. Some of the key façade players in Indian market include:

The Road Ahead : The glass façade systems are seeing some smart innovations primarily focusing on sustainability, energy efficiency, and aesthetic appeal. This includes – smart glass technology (adjust its tint based on external conditions), energy-efficiency coatings, integrated solar panels, responsive facades, etc.

Some recent transactions

| Dec’23 | ACIL | Ramkrishna Forging acquired 100% of the auto comps manufacturer. |

| Dec’23 | Blu Smart | The EV ride-hailing platform raised ₹340 Cr. in a fundraise led by BP Ventures. |

| Dec’23 | Batx Energies | The Li-ion battery recycler raised ₹42 Cr. in a fundraise led by Zephyr Peacock. |

| Dec’23 | Exponent Energy | The EV battery manufacturer raised ₹220 Cr. in a fundraise led by Eight Roads Ventures. |

| Dec’23 | Coreel Technologies | IIFL Asset Management invested ₹135 Cr. in the EMS company. |

| Dec’23 | Goapptive | Cipla limited acquired a stake in the healthcare SaaS company for ₹ 42 Cr. |

Recent News

- Though US Fed left interest rates unchanged, global equity markets surged on strong indications of interest rate cuts (at least 3 expected) in 2024; European Central Bank and Bank of England also kept their rates on hold

- With expected drop-in interest rates, the price of other risky assets also surged – Bitcoin touched US$ 44,000, the highest level in 20 months and gold also has nudged up to ~INR 65,000 for 10gms

- The IPO market in India saw significant activity in December with 12 new mainboard IPOs raising ~9000 Crores; overall 2023 has seen 52 mainboard IPOs and 173 SME listing raise over Rs 65,000 crore

- According to the study by Colliers, Gujarat achieved the highest investment in the manufacturing sector in in India in 2023 of over US$ 3.6bn followed by Maharashtra and Tamil Nadu

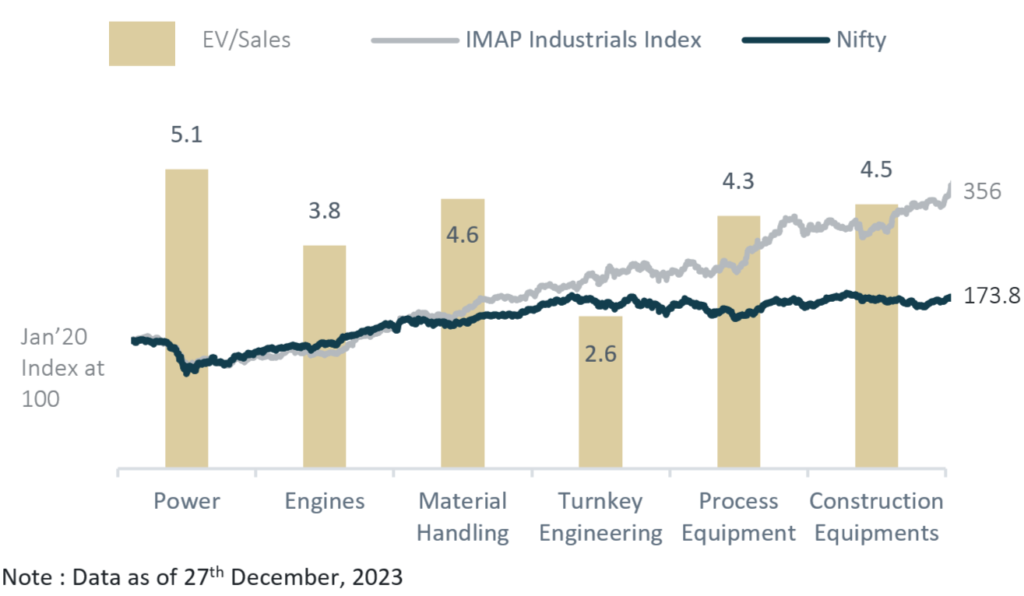

IMAP Industrials Index & Valuation of sub-segments

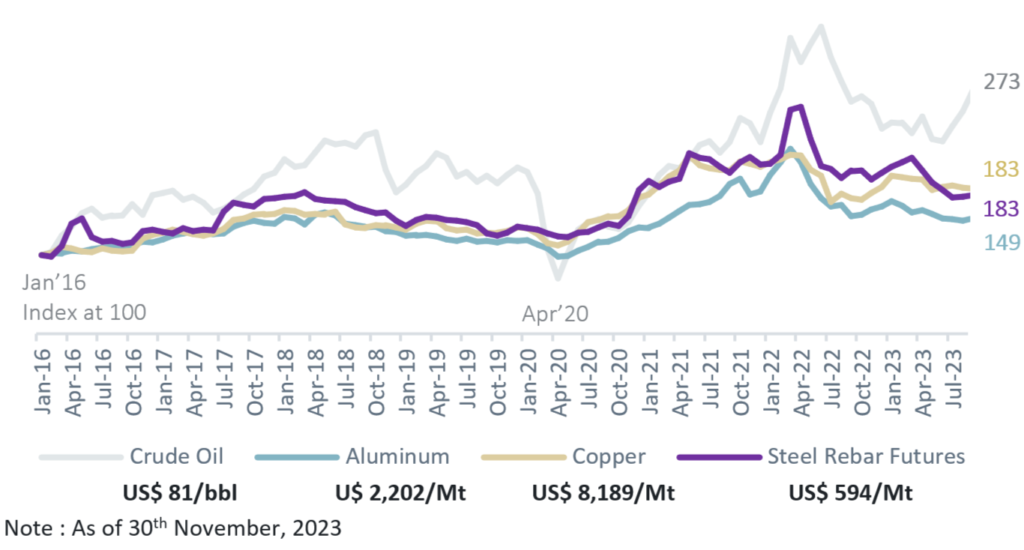

Commodity Prices Index

IMAP – International M&A Partners is an independent organization focused purely on M&A and transaction success. With over 450 M&A professionals based in over 43 countries, we work together in seamless cross-border sector teams and address each assignment with talent and dedication. We advise primarily mid-sized companies and their shareholders on the sale and acquisition of companies on a global scale.

Reach out to us to discuss more :

- Praveen Nair : +91-9820330033 / praveen@imapindia.in

- Puneet Kochar : +91-9810287367 / puneet@imapindia.in

- Ranga Prasad: +91-9885122544 / ranga@imapindia.in