Industrial Update – Newsletter – Nov 2023

IMAP’s Industrials group brings you this monthly update with a focus on latest news, transactions and interesting snippets from the Industrials domain in India

EV Charging Infrastructure – anticipating high level of activity!

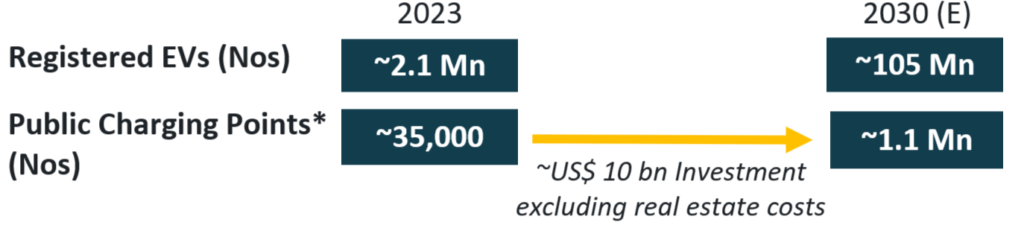

India is expected to be home to ~100 Mn EVs by 2030 driving the need to significantly improve our public charging infrastructure

The charging stations will have a mix of slow charging points (2-3 AC chargers) and fast charging points (2-3 DC chargers); the average cost to set up a charging station is estimated to be INR 3 – 4 million (excluding land costs). Consumers in general are expected to use public chargers to facilitate secondary top-ups to ease range anxiety with base charging being done at home/office using private AC chargers. Technology for charging has also evolved to make charging safer and time taken shorter.

The players emerging in the EV charging space include:

Charging station provider – Focus is to establish and operate public chargers, securing key locations and expecting revenue ramp up as vehicle volumes increase

Charger Manufacturers – Focus is on building/providing the charging Hardware + Software to EV OEMs and/or to public charging stations

Charging Management System (CMS) Providers and Aggregators: Consolidates/maps charging locations, roviding analytics, etc.

Some recent transactions

| Nov’23 | Maini Precision | Raymond Group acquired 59.3% of the precision product manufacturer for ₹680Cr. |

| Nov’23 | Euler Motors | The EV OEM raised ₹120 Cr. in a fundraise led by CDC Group and Blume Ventures |

| Nov’23 | Biocon Biologics | Eris Lifesciences acquired the dermatology and nephrology units for ₹366 Cr. |

| Nov’23 | Aquapharm Chemicals | 100% acquisition by Phillips Carbon Black Limited for ₹3800 Cr. |

| Nov’23 | Inkodop Technologies | The electric cycle manufacturer raised ₹166 Cr. in a fundraise led by Alteria Capital |

| Nov’23 | Samplytics | The health tech company raised ₹50 Cr. in a fundraise led by Fireside Ventures |

Recent News

- Data indicating sharp drop in Oct’ inflation (from 3.7% to 3.2% in US; 6.7% to 4.6% in UK; 2.9% to 2.4% in EU) led to a strong equity rally globally in November, anticipating a future hold/drop in interest rates

- Nvidia unveiled its top-of-the-line chipset, the H200; with 2x the capacity than its earlier chip, is targeted at generative AI. Nvidia, with market cap of US$ 1.15 T, saw an over 3x valuation rise since Jan’23

- Electric Two-Wheeler (E2W) sales in India increased to 91,253 units in Nov’23 from 74,951 units last month; Ola maintained its leadership position with market share of 32.6% followed by TVS (20.8%), Bajaj (12.8%), Ather (10.1%) and Greaves (4.8%)

- Regaining its output growth momentum, manufacturing sector expanded in November with PMI Index rising to 56.0 as compared to 55.5 in October – a number above 50 indicates overall growth

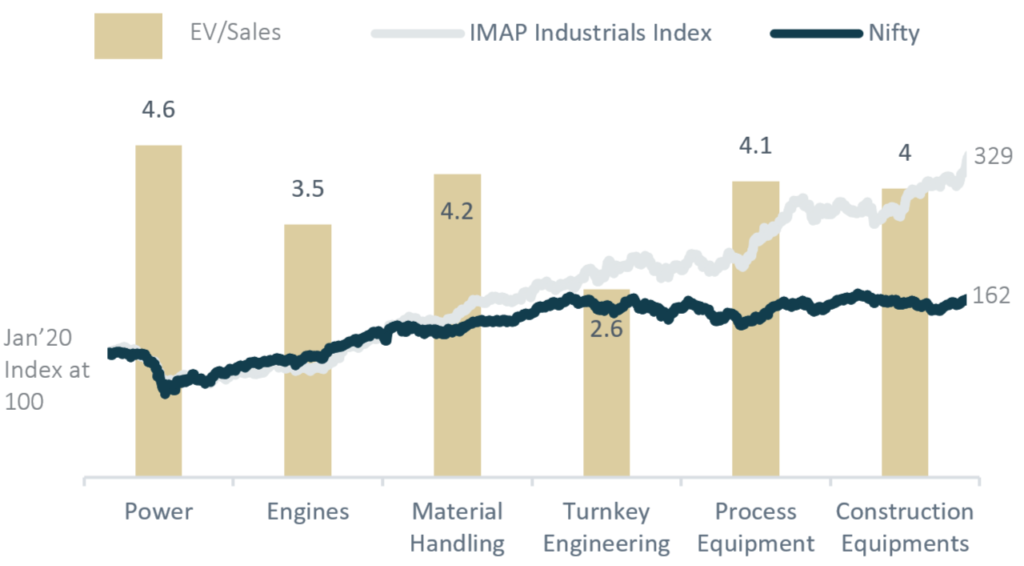

IMAP Industrials Index & Valuation of sub-segments

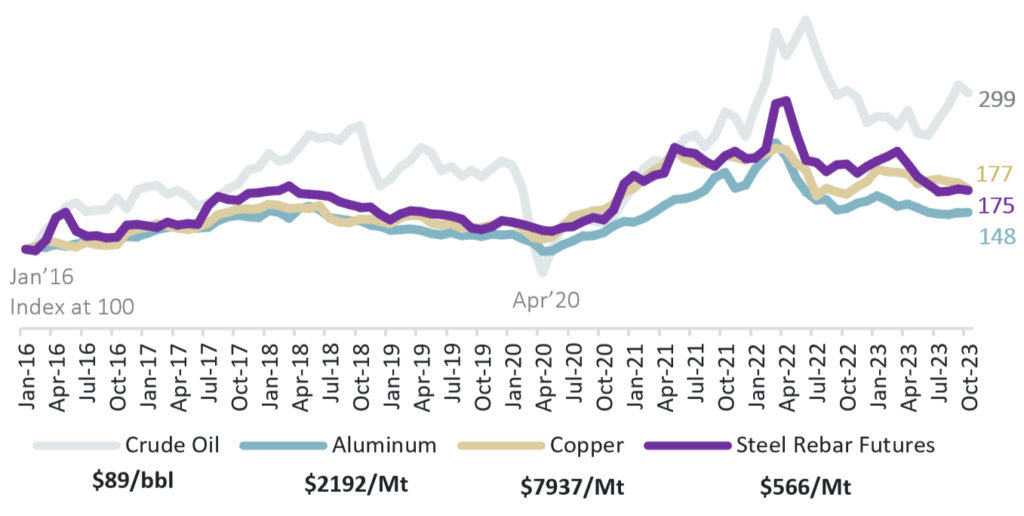

Commodity Prices Index

IMAP – International M&A Partners is an independent organization focused purely on M&A and transaction success. With over 450 M&A professionals based in over 43 countries, we work together in seamless cross-border sector teams and address each assignment with talent and dedication. We advise primarily mid-sized companies and their shareholders on the sale and acquisition of companies on a global scale.

Reach out to us to discuss more :

- Praveen Nair : +91-9820330033 / praveen@imapindia.in

- Puneet Kochar : +91-9810287367 / puneet@imapindia.in

- Ranga Prasad: +91-9885122544 / ranga@imapindia.in