Industrial Update – Newsletter – March 2024

IMAP’s Industrials group brings you this monthly update with a focus on latest news, transactions and interesting snippets from the Industrials domain in India

Semiconductor Packaging – why the big rush in India!

Semiconductor packaging refers to the process of enclosing integrated circuits (ICs) or microchips, in a protective casing (a package). The packaging serves several important functions such as protecting the semiconductor components from damage, providing electrical connections for input and output signals, dissipating heat generated, etc.

While India has been trying to build mega semiconductor factories, it is simultaneously looking at different approaches to capture a share of the global semiconductor supply chain. An important aspects of manufacturing semiconductor chips is packaging and testing (apparently contributes 15% of the semicon value chain) which could be outsourced by a semiconductor foundry to a specialized 3rd party called OSAT (Outsourced Semiconductor Assembly and Testing). OSAT providers have expertise in packaging technologies – to select appropriate package types (legacy to advanced packages), mount the chips onto packages, connecting them to external pins or solder balls and encapsulating the chips in protective materials. ATMP (Assembly, Testing, Marking and Packing) and

OSAT terms are used interchangeably; ATMP is a broader term and is used when semicon manufacturers perform the packing and testing inhouse.

The overall size of the global OSAT industry is estimated to be ~US$ 45 billion growing at 6% – 9% wherein Taiwan and China dominate with a combined market share of 75 %. To push for the development of semiconductors manufacturing ecosystem in India, GoI has put together an outlay of over US$ 10 billion which includes fiscal support of 50% of capex for setting up of semiconductor ATMP/OSAT facility; an additional 20% support from the state is also available. As OSATs build capability by learning the product, technology and process, they could then expand along the semicon value chain

Select players

Some recent transactions

| Mar’24 | Newspace Research | The Drone manufacturer raised ₹273 Cr. in a fundraise led by Cornerstone Ventures |

| Mar’24 | Bonatras | Jupiter Wagons acquired the auto component manufacturer for ~₹270 Cr |

| Mar’24 | Biocon Biologics | Eris life sciences acquired the branded formulations are of Biocon for ₹1,242 Cr |

| Mar’24 | Lohum Cleantech | The Li-Ion battery manufacturer raised ~₹447 Cr. in a fundraise led by Singularity AMC |

| Mar’24 | Vodafone | ATC Telecom acquired a 2.9% stake for ₹1,600 Cr. as a strategic investment round |

| Mar’24 | Vasant Chemicals | ICIG acquired a majority stake in the specialty chemicals manufacturer for an undisclosed amount |

Recent News

- GOI launched the Indian AI Mission with a budget outlay of ~US$ 1.25 Bn to foster innovation in AI through public-private partnerships (PPPs) including investing in financing deeptech startups

- India’s manufacturing PMI grew to 59.2 in March from 56.9 in the previous month; a PMI value above 50 indicates growth

- A big event on the EV calendar was launch of its debut electric car, the SU7, by Chinese tech giant Xiaomi; aggressively priced, the SU7 is expected to compete head-to-head with Tesla, BYD and others

- As a boost for urban mobility, the Indian PM inaugurated multiple metro and connectivity projects worth ~US$ 2 billion including Kolkata’s underwater metro tunnel

- Inda’s merchandise exports increased 11.9% y-o-y to a 11-month high of $41.40 bn in Feb’24 while imports increased 12.2% to $60.11 bn

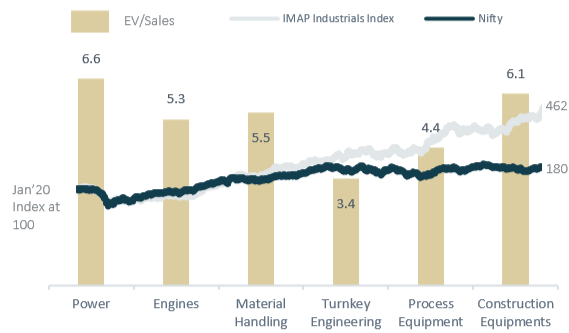

IMAP Industrials Index & Valuation of sub-segments

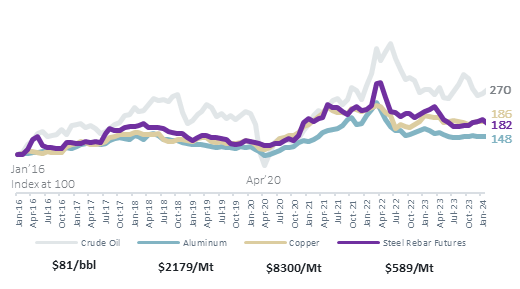

Commodity Prices Index

IMAP – International M&A Partners is an independent organization focused purely on M&A and transaction success. With over 450 M&A professionals based in over 43 countries, we work together in seamless cross-border sector teams and address each assignment with talent and dedication. We advise primarily mid-sized companies and their shareholders on the sale and acquisition of companies on a global scale.

Reach out to us to discuss more :

- Praveen Nair : +91-9820330033 / praveen@imapindia.in

- Puneet Kochar : +91-9810287367 / puneet@imapindia.in