Industrial Update – Newsletter – February 2024

IMAP’s Industrials group brings you this monthly update with a focus on latest news, transactions and interesting snippets from the Industrials domain in India

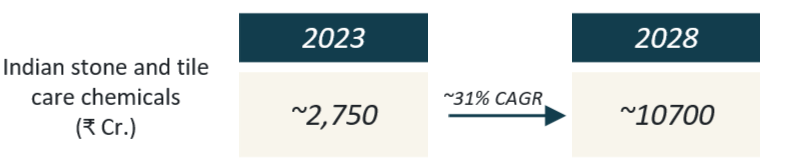

Indian stone and tile care chemical market – expected to be a US@$ 1.5 billion opportunity

India is the 3rd largest producer, consumer, and exporter of natural stones and tiles globally. Despite this, the penetration of stone and tile care products (encompassing adhesives, sealants, polishers, enhancers, etc.) is still low at ~18%, with a bulk of tiling repair and tile attachment still being done using cement.

As of 2023, the market for tile and stone-care products in India is estimated to be between ~₹2,500 Cr – ~₹3,000 Cr. With the growth of tiling and stone industry estimated at 7-8% coupled with the increase in penetration of stone and tile chemicals to ~50%, the overall market for these products could likely see a 4x growth over the next 5 years.

The key products include Grouts (used for filling joints, holes, and hairline cracks in stones and tiles), Adhesives (used to install tiles/ stones on floors and walls), Enhancers (used on stone surfaces to enrich natural colors), Sealants (used to penetrate the porous stone to enhance longevity and enable ease of maintenance), Polishing Compounds (used to restore dull surfaces to their original gloss), Cleaners (specialized detergents used to clean stone surfaces). While in tile care space (especially tile adhesives) has a good presence of most Indian players, the stone care chemicals segment is largely catered to by global players (mainly German and Italian companies)

Select players

Some recent transactions

| Feb’24 | River Mobility | The EV OEM raised ~₹330 Cr. in a fundraise led by Yamaha and Toyota Ventures |

| Feb’24 | Yulu Bikes | Baja Auto and Magna invested ₹160 Cr. in the urban mobility service provider |

| Feb’24 | Swiss Parenterals | Eris Lifesciences acquired 51% of the pharma formulations manufacture for ~₹ 640 Cr. |

| Feb’24 | Toshali Cements | JK Cements acquired a 100% stake in the cement and steel manufacturer for ₹90 Cr. |

| Feb’24 | Lohum Cleantech | The Li-Ion battery manufacturer raised ~₹190 Cr. in a fundraise led by Baring Private Equity |

| Feb’23 | Tork Motors | The EV 2-wheeler manufacturer raised ₹50 Cr. in a fundraise led by Maxis Capital |

Recent News

- In a significant step, GoI has approved a proposal from Tata Electronics to build a semiconductor fab facility in Dholera, Gujarat in partnership with PSMC, Taiwan with a total investment of ₹ 91,000 Cr

- Nvidia, the American chip manufacturing company, emerged as the world’s 4th most valuable company (after Microsoft, Apple and Saudi Aramco) with a market cap of ~US$ 1.97 Trillion

- Indian Manufacturing PMI grew to 56.7 in February, from 56.5 in the previous month; a PMI value above 50 indicates growth

- The GOI launched 2,000 railway infrastructure projects (essentially covering redevelopment of 554 railway stations and the construction of 1,500 roads over/under bridges), worth ~₹41,000 Cr

- In a move to boost the space sector and increase the ease of doing business, GOI has approved FDI investment of 100% in this sector

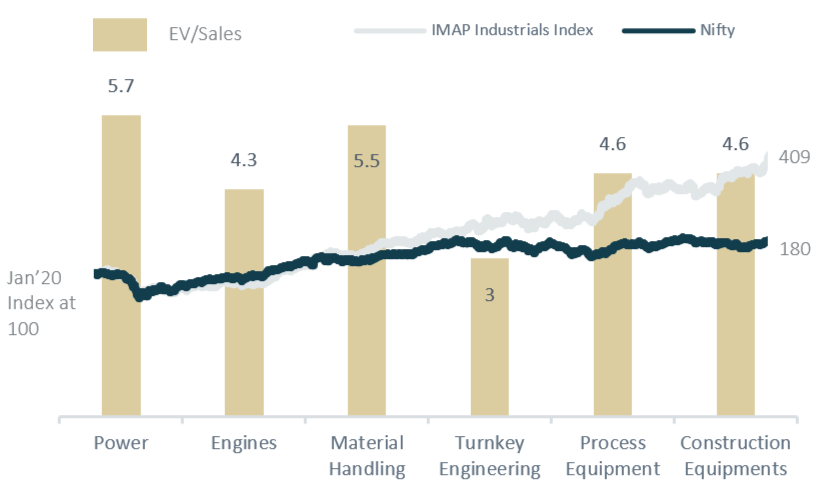

IMAP Industrials Index & Valuation of sub-segments

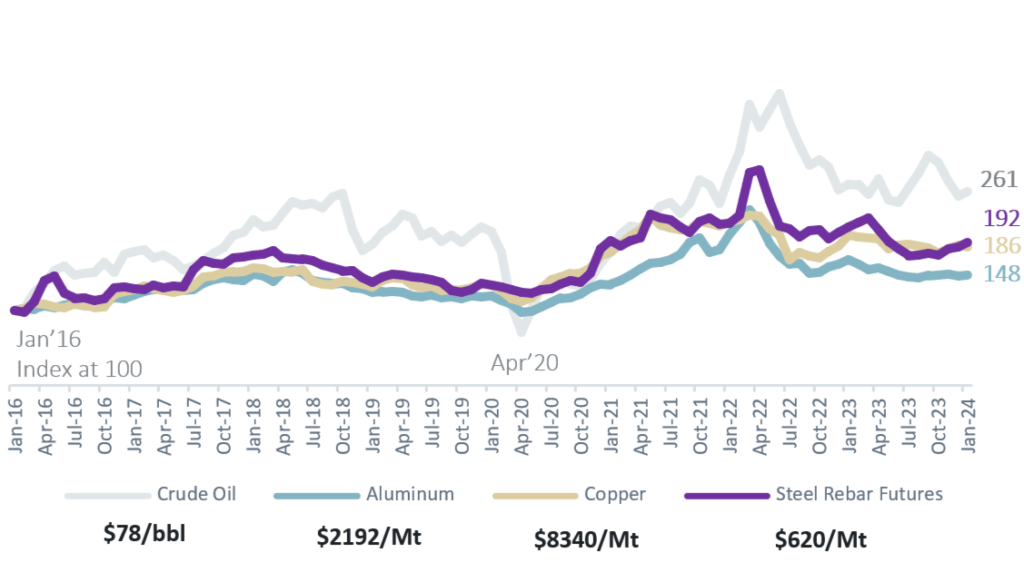

Commodity Prices Index

IMAP – International M&A Partners is an independent organization focused purely on M&A and transaction success. With over 450 M&A professionals based in over 43 countries, we work together in seamless cross-border sector teams and address each assignment with talent and dedication. We advise primarily mid-sized companies and their shareholders on the sale and acquisition of companies on a global scale.

Reach out to us to discuss more :

- Praveen Nair : +91-9820330033 / praveen@imapindia.in

- Puneet Kochar : +91-9810287367 / puneet@imapindia.in