Industrial Update – Newsletter – Oct 2023

IMAP’s Industrials group brings you this monthly update with a focus on latest news, transactions and interesting snippets from the Industrials domain in India

E-waste Management in India – a high growth opportunity!

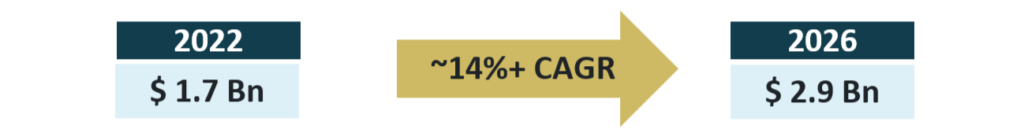

Out of 59.4 million MT of electronic waste generated globally in 2022, India generated 1.71 million MT, i.e. 3% of global volume. Of this, over 95% of the e-waste management in India is unorganized. The total size of the e-waste market in India is estimated to be worth $1.7 billion and is expected to grow at a rate of 14%+ till 2026

GoI, to formalise e-waste recycling, has taken several steps – these include compulsory registration of recycling/dismantling units, guidelines/SOP for processing of e-waste, Extended Producer Responsibility (EPR) wherein specific recycling targets are given to electric and electronic equipment (EEE) manufacturers and provision for generation and transaction of EPR certificate among others.

The rules are covered under E-Waste (Management) Rules, 2022 which replaced the earlier E-waste (Management) Rules, 2016. India expects to overcome several challenges facing the e-waste recycling industry – lack of awareness, informal sector dominance, inadequate infra, etc.

The rising electronics consumption in India along with a more favorable regulatory structure makes e-waste management an attractive industry. Several companies are expanding/entering in this space. Firms like Attero (battery recycling), Rapidue (e-waste recycling platform), Gravita (lead production from recycled scrap) are able to grow and also raise funding

Some recent transactions

| Oct’23 | Zetwerk | The contract manufacturing startup raised ₹999 Cr. in a fundraise led by Avenir Capital |

| Oct’23 | Exponent Energy | The EV battery manufacturer raised ₹200 Cr. in a fundraise led by Eight Roads Ventures |

| Oct’23 | Ship Rocket | AFOS LLC invested ₹90 Cr. in the logistics SaaS company for a 0.91% stake |

| Oct’23 | Garuda Aerospace | The drone manufacturer raised ₹25 Cr. from Venture Catalysts |

| Oct’23 | Freight Tiger | Tata Motors invested ₹150 Cr. for a 27% stake in the logistics SaaS company |

| Oct’23 | PMI Electro Mobility | Piramal Alternatives invested ₹250 Cr. in the electric bus manufacturer |

Recent News

- BYD is set to surpass Tesla in EV sales – in 3rd quarter 2023, BYD shipped 432,000 BEVs compared to Tesla’s 435,000 units. The gap has been reducing q-o-q with BYD set to overtake Tesla next quarter

- Somewhat bucking the funding drought in the startup space, October saw total funding of US$ 1.24 billion (debt made up for 1/3rd of it) to 95 Indian startups, a small but definitive jump over previous months

- The growth in manufacturing sector in India slowed down in October (lowest since Feb’23) as per PMI Index that slipped to 55.5 from 57.6 in September – a number above 50 indicates overall growth

- International Energy Agency predicts that the global demand for oil, natural gas and coal which has so far been expanding y-o-y will peak by 2030 and thereafter plateau, indicative a significant shift to renewable energy sources globally

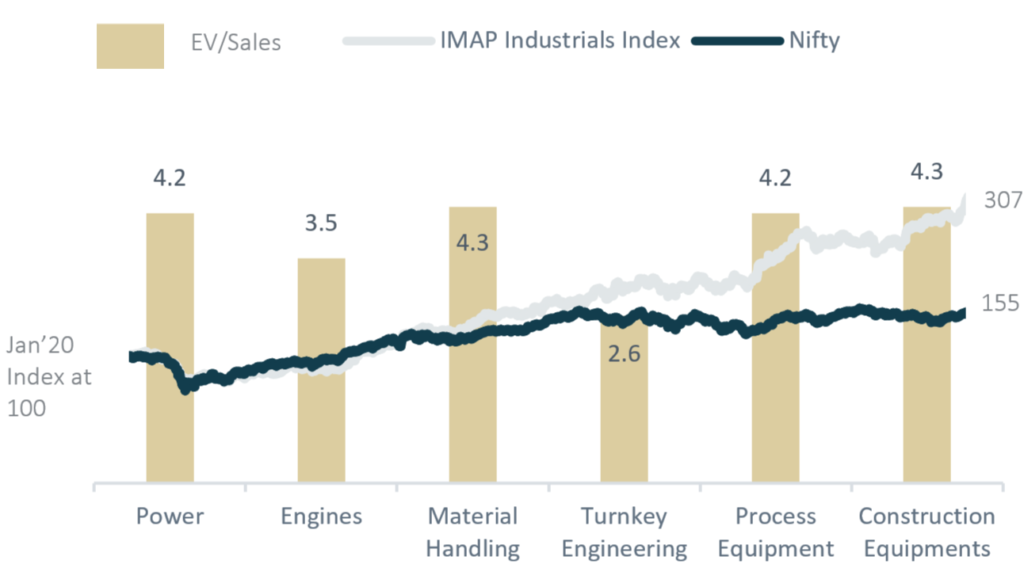

IMAP Industrials Index & Valuation of sub-segments

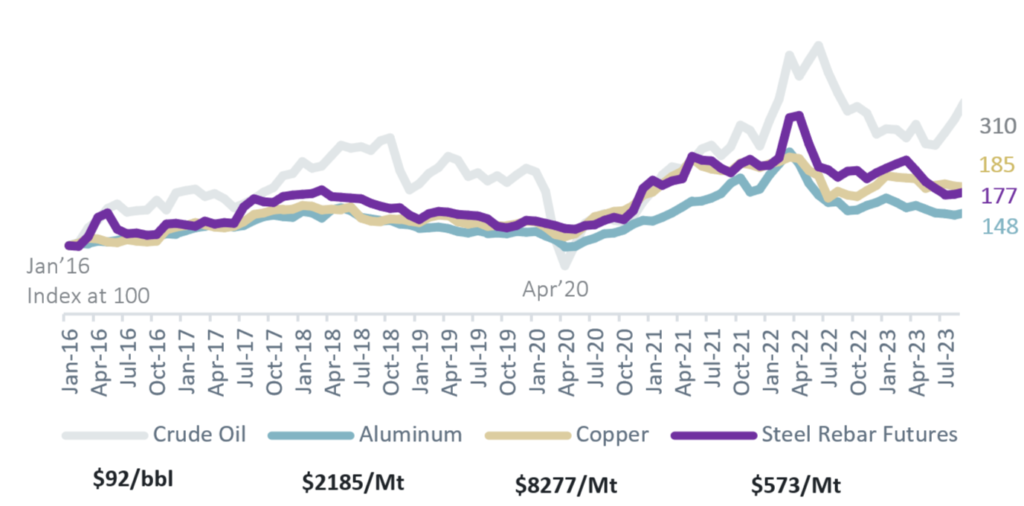

Commodity Prices Index

IMAP – International M&A Partners is an independent organization focused purely on M&A and transaction success. With over 450 M&A professionals based in over 43 countries, we work together in seamless cross-border sector teams and address each assignment with talent and dedication. We advise primarily mid-sized companies and their shareholders on the sale and acquisition of companies on a global scale.

Reach out to us to discuss more :

- Praveen Nair : +91-9820330033 / praveen@imapindia.in

- Puneet Kochar : +91-9810287367 / puneet@imapindia.in

- Ranga Prasad: +91-9885122544 / ranga@imapindia.in