Industrial Update – Newsletter – August 2023 : IMAP’s Industrials group brings you this monthly update with a focus on latest news, transactions and interesting snippets from the Industrials domain in India

ONDC: Challenging the dominance of incumbent E-Commerce Giants!

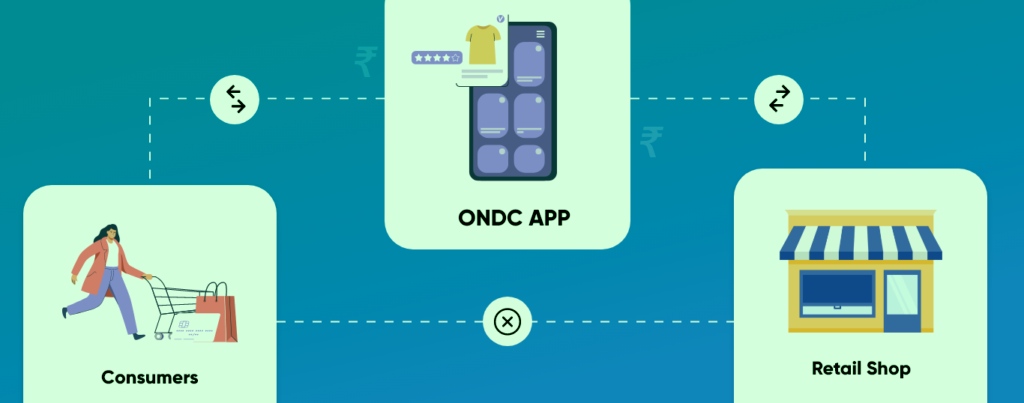

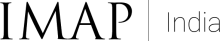

Conceptualized by the Government of India, ONDC (Open Network for Digital Commerce) is an open protocol network that aims to unbundle online transactions into smaller activities that could be fulfilled by different entities under a common protocol

Need for ONDC: Currently, platform centric models (Amazon, Swiggy, Flipkart) have end-to-end control of transactions. Leading to; High entry barriers with consolidation of the sector into few siloed marketplaces, Limited power with sellers as platforms set all terms and conditions, No interoperability between platforms, forcing sellers to replicate effort & investment on all platforms and Low e-commerce penetration in rural & Tier-2 markets as they have been neglected by existing platforms

The Numbers: The network has been operational in 273 cities since Sep’22, with 150k sellers from across the country. Currently, the platform sees ~40,000 transactions a day

For Buyers: Freedom to select the seller and transaction enablers like payment portal, logistics provider, credit/insurance provider etc

For Sellers: Need not replicate effort across platforms, low entry barrier for smaller sellers, stronger terms of trade

Leading players on ONDC:

Some recent transactions

| Aug’23 | Johari Digital | Syrma SGS acquired a 51% stake in the medical device manufacturer for ₹230 Cr. |

| Aug’23 | Waree Energies | Value Quest Capital invested ₹1000 Cr. in the renewable energy company. |

| Aug’23 | Fourth Partner Energy | The energy solutions provider raised ₹350 Cr. in a fundraise led by Norfund |

| Aug’23 | Stellar Value Chain | CEVA Logistics acquired a 96% stake in the company. |

| Aug’23 | Amber Enterprises | GIC Singapore acquired a 3.74% stake in the company for ₹353 Cr. |

| Aug’23 | Botlab Dynamics | The Drone manufacturer raised ₹ 20 Cr. in funding from Florintree Advisors |

Recent News

- GOI’s PLI scheme 2.0 for IT Hardware, drew interest from 32 companies including global majors such as HP , Dell, Acer, Lenovo etc. With an outlay of 17,000 Crores, the scheme is expected to see incremental production of Rs 3.35 lakh crore and create 75,000 jobs

- Demonstrating a global shift to accelerated computing and generative AI, revenues of Nvidia (it supplies most chips to this segment) jumped by 170% to $13.5bn+ for Apr-Jun quarter of 2024. Nividia also became the 7th U.S. company to cross the $1 trillion market cap threshold

- In heating geo-political war between US and China, US has restricted its PE/VC funds from investing in certain advanced technologies (AI, qantum computing & semiconductors) in China

- Manufacturing PMI in July’23 was at 57.7 remaining flattish (compared to 57.8 in June’22); PMI value above 50 indicates growth

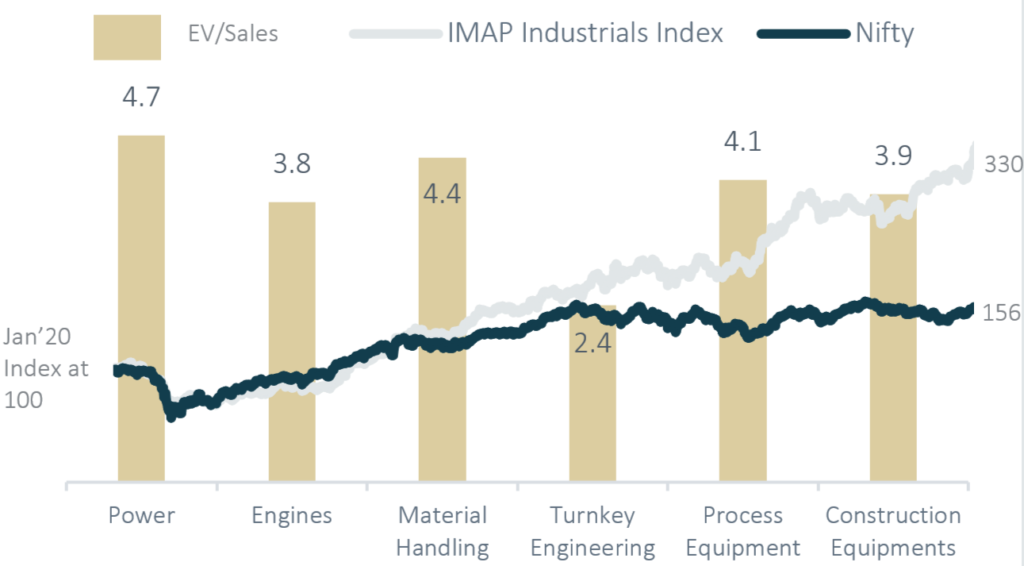

IMAP Industrials Index & Valuation of sub-segments

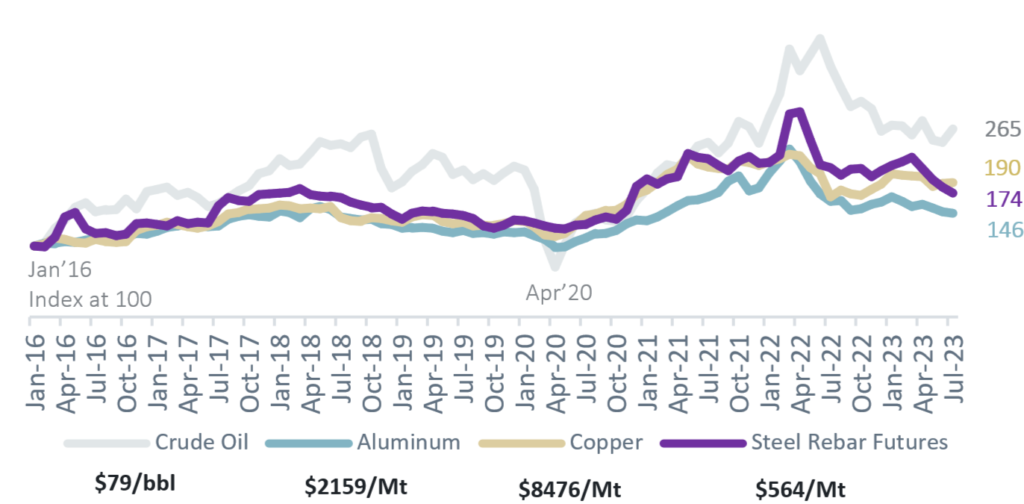

Commodity Prices Index

IMAP – International M&A Partners is an independent organization focused purely on M&A and transaction success. With over 450 M&A professionals based in over 43 countries, we work together in seamless cross-border sector teams and address each assignment with talent and dedication. We advise primarily mid-sized companies and their shareholders on the sale and acquisition of companies on a global scale.

Reach out to us to discuss more :

- Praveen Nair : +91-9820330033 / praveen@imapindia.in

- Puneet Kochar : +91-9810287367 / puneet@imapindia.in

- Ranga Prasad: +91-9885122544 / ranga@imapindia.in