Industrial Update – Newsletter – September 2023

IMAP’s Industrials group brings you this monthly update with a focus on latest news, transactions and interesting snippets from the Industrials domain in India

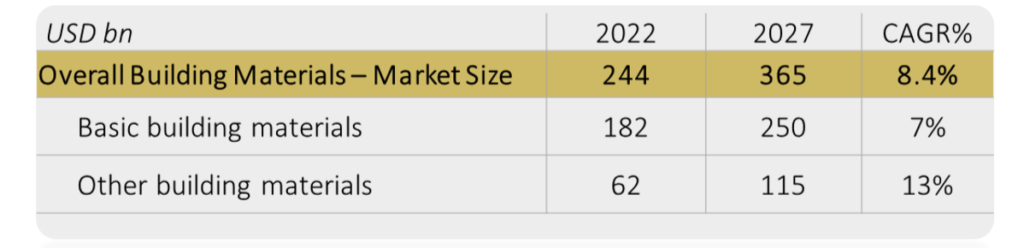

Building Materials Space: A US$ 244 billion market

Building materials industry in India is expected to grow from estimated $244 bn in FY22 to $365 bn in FY27, at about 1.2 to 1.3x of estimated GDP growth during this period.

Basic building materials comprise steel, cement, aggregates, bricks, etc. which makeup ~70-75% of the total market size and is expected to grow at ~7% over FY22-FY27. Other building materials comprises paints, tiles construction chemicals, glass, non-wooden doors and windows, composite panels, plumbing fittings, etc. Though smaller in overall size, this segment is expected to grow much faster at ~13%

New materials and categories in building materials have emerged due to – need to reduce labor component in construction and maintenance costs, reduction of construction time, enhancement in performance & durability of construction, overall aesthetics and a greater emphasis on environment friendly materials.

Construction material industry, which is largely B2B has seen strong digital adoption; In India, B2B online penetration is currently ~1% and is expected to increase to 6% in next 5 years – some of the players in this space include Infra.Market, OfBusiness, Brick&Bolt etc. Also, within this space, the following product categories are witnessing strong growth:

Some recent transactions

| Sep’23 | Ather Energy | The EV scooter manufacturer raised ₹ 900 Cr. from Hero Motocorp and GIC Singapore. |

| Sep’23 | Kale Logistics | Creaegis invested ₹248 Cr. in the logistics SaaS company. |

| Sep’23 | Ola Electric | Temasek invested ₹1163 Cr. for a 2.55% stake in the EV manufacturer. |

| Sep’23 | Raptee Motors | The EV manufacturer raised ₹25 Cr. in a fundraise led by BlueHill Capital. |

| Sep’23 | Everest Fleet | The B2B fleet management company raised ₹50 Cr. from Paragon Partners. |

| Sep’23 | Resowi Energy | Inox Green Energy acquired a 51% stake for an undisclosed amount. |

Recent News

- OECD estimate of world GDP growth was upgraded to 3% (from 2.7%) for 2023 despite the weaker-than-expected recovery in China

- China’s $18 trillion economy has been struggling- manufacturing activity contracted for a fifth straight month in August, growth in the country’s services sector has weakened and consumers are spending less; also stress in the real estate segment as its largest real estate developer, Country Garden, missed payments on its bonds

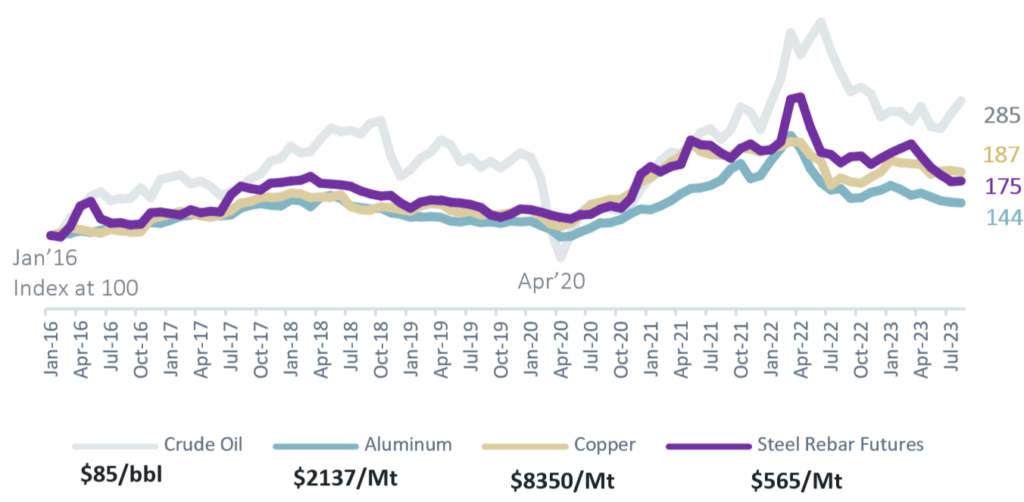

- Brent crude rose to US$ 95 per barrel (highest in almost a year) as Saudi Arabia and Russia extended their voluntary oil production cuts

- Manufacturing PMI for India in August’23 was at 58.6 (compared to 57.7 in July’23); PMI value above 50 indicates growth

- Arm Holdings, the chip design company controlled by SoftBank came out with much anticipated IPO valuing the company at ~$60 billion

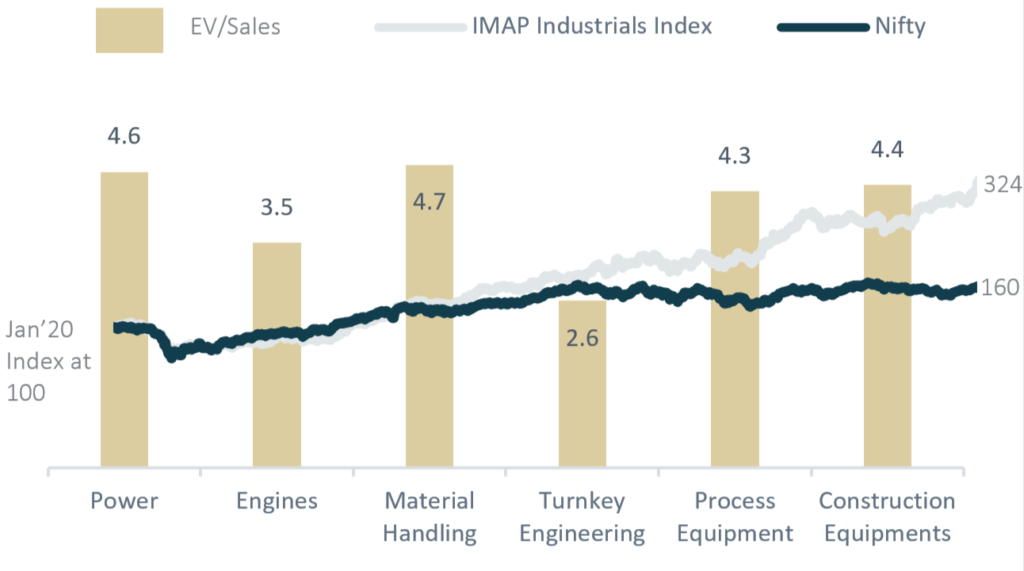

IMAP Industrials Index & Valuation of sub-segments

Commodity Prices Index

IMAP – International M&A Partners is an independent organization focused purely on M&A and transaction success. With over 450 M&A professionals based in over 43 countries, we work together in seamless cross-border sector teams and address each assignment with talent and dedication. We advise primarily mid-sized companies and their shareholders on the sale and acquisition of companies on a global scale.

Reach out to us to discuss more :

- Praveen Nair : +91-9820330033 / praveen@imapindia.in

- Puneet Kochar : +91-9810287367 / puneet@imapindia.in

- Ranga Prasad: +91-9885122544 / ranga@imapindia.in