Industrial Update – Newsletter – Jan 2023: IMAP’s Industrials group brings you this monthly update with a focus on latest news, transactions and interesting snippets from the Industrials domain in India

India’s big renewable energy push!

India is today the 3rd largest producer of renewable energy (RE) in the world, with 40% of its installed electricity capacity coming from non-fossil fuel sources.

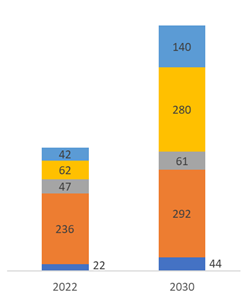

As India targets 500 Giga Watt (1GW = 1000 MW) RE capacity by 2030, we need to add ~100 GW of capacity in wind and ~220 GW in solar capacities, requiring investment of over US$ 200 billion

Further, India has promised to cut its emissions to net zero* by 2070 (US and EU have taken this target for 2050 and China for 2060) which would require significant RE energy capacity and other measures on emissions.

To boost the growth of RE, India has a enacted several policies – National Tariff Policy (mandates a min % of RE power to be procured by distribution companies), National Solar Mission (target for solar capacity addition), National Wind Energy Mission (target for wind capacity addition), National Biofuels Policy (allow more feedstocks, ethanol blending, etc.), Accelerated Depreciation Policy (40% to 60% of depreciation in 1st year itself), Net Metering Policy (credits for adding power to grid).

The larger players in India in the RE space with their commissioned capacities: ReNew Power (~8 GW), Adani Green (7+ GW), Greenko Group (4+ GW) Tata Renewable Energy (~4 GW), Mytrah Energy (~2 GW), Hero Future Energies (~1.6 GW)

Some recent transactions

| Jan’23 | SAEL Limited | ₹500 Cr invested by Norway’s climate investment fund |

| Jan’23 | Silver Pumps | Plutus Wealth Management invested ₹80 Cr. for a 20% stake in the company |

| Jan ’23 | Khargone Transmission | Indian Trust Grid acquired 100% of the company for 1497 Cr. |

| Jan’23 | Meenakshi Energy | Vedanta Limited acquired 100% of the business for 1440 Cr. |

| Dec’22 | Dr. Axion | Craftsman Automation acquired 76% of the company for 375 Cr. |

| Dec’22 | Faurecia India | TAFE group acquired the interior systems business for 400 Cr. |

Recent News

- Microsoft increased its stake in OpenAI, the AI firm that developed ChatGPT, a conversational AI model; Microsoft apparently infused US$10 billion at an estimated valuation of ~US$29 billion

- China’s economy grew by just 3% in 2022, the weakest since 1976 apart from 2020. As measures, apart from a shift away from its zero-covid policy, it recently eased its crackdown on tech companies and loosened restrictions on financing for property developers

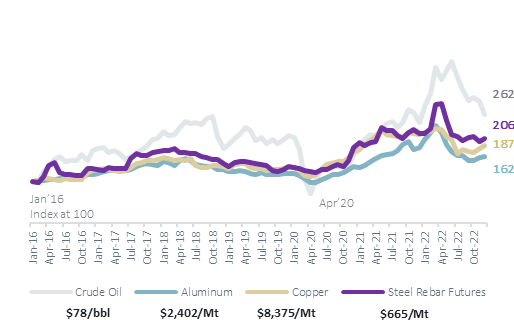

- Brent crude settled to $84-$85 per barrel in Jan’23 (steadily declining from ~US$100 in Jul’22) thanks to a milder winter, EU slowdown and more recently U.S. business activity contracting

- Manufacturing PMI in Dec was at 57.8 (compared to 55.7 in Nov’22); PMI value above 50 indicates growth. In the US, the value dropped to 48.4 in Dec’22 (was 49.0 in Nov’22), the weakest in last 2.5 years

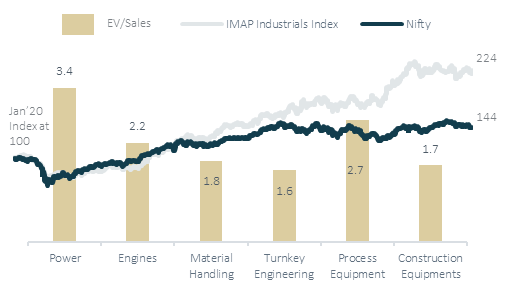

IMAP Industrials Index & Valuation of sub-segments

Commodity Prices Index

IMAP – International M&A Partners is an independent organization focused purely on M&A and transaction success. With over 450 M&A professionals based in over 43 countries, we work together in seamless cross-border sector teams and address each assignment with talent and dedication. We advise primarily mid-sized companies and their shareholders on the sale and acquisition of companies on a global scale.

Reach out to us to discuss more :

- Praveen Nair : +91-9820330033 / praveen@imapindia.in

- Puneet Kochar : +91-9810287367 / puneet@imapindia.in

- Ranga Prasad: +91-9885122544 / ranga@imapindia.in