Industrial Update – Newsletter – April 2023 : IMAP’s Industrials group brings you this monthly update with a focus on latest news, transactions and interesting snippets from the Industrials domain in India

What’s happening in Agri-tech

Agritech, or agricultural technology, encompasses the range of technological innovations that aim to improve the efficiency, productivity, and sustainability of farming and other agricultural practices. It is estimated that India has more than 450 agri-tech startups that operate across the following key Agri-Tech categories:

Precision Agriculture: Involves use of sensors, drones, GPS mapping and other tech to collect data on crop health, soil moisture and other factors, which is then used to optimize crop yields, reduce waste, etc. e.g. Intello Labs, Fasal, BharatAgri, Fyllo, Euruvaka, CropIn, Stellapps

Biotechnology & Biomaterials: Includes bio-inputs, food preservation tech, plant breeding, genetic engineering of seeds (this is done largely by established firms), etc. e.g. String Bio, Sea6, BioPrime, FIB-SOL, Tropical Animal Genetics

Supply Chain Tech: This category accounts for most of the Ag-tech investments. On one end it has companies focusing on digitalization of the input supply chains for farmers (e-commerce in seeds, pesticides, animal feed, etc.) and at other end it uses tech/e-commerce tools to take agri and other farm products to consumers. e.g. Agrostar, Bighaat, BigBasket, Ninjacart, DeHaat, Waycool, Grophers, Licious etc.

Mechanization: Includes automated machinery and tools (hardware /software) that help reduce labor costs, increase efficiency, and improve accuracy e.g. Ecozen, Tessol, and Eeki Foods.

Other Agri-Tech categories include – Food Processing and Preservation, Agri Infrastructure Tech, Agri-Finance Tech and Aquaculture Tech.

The total value of investments into agri-tech startups was US$ 846 million in 2022 – was US$ 889 million in 2021 & US$ 412 million in 2020

Some recent transactions

| Apr’23 | Celcius Logistics | Cold-chain logistics player raised ₹65 Cr from IvyCap Ventures |

| Apr’23 | Excel Controlinkage | Greaves Cotton acquired 60 % of the firm for ₹ 385 Cr. |

| Apr’23 | Unichem Laboratories | Ipac Labs invested ₹,1034 Cr. for 33.38% of the company |

| Apr’23 | Aequs Pvt Ltd | The contract manufacturer raised ₹225 Cr from Amicus capital for 9.14% |

| Apr’23 | Magenta EV Solutions | ₹180 Cr fund-raise led by Morgan Stanley infrastructure partners and BP ventures. |

| Apr’23 | Appel Chemie | Indigo Paints acquired 51% of the construction chemicals business for ₹29 Cr |

Recent News

- As per IEA, global sales of EVs rose 25% in the period Jan-Mar’23 compared to last year – EV sales to become 18% of total car sales by end-2023 driven by China, which accounts for 60& of EV sales

- The export of smartphones from India crossed $10 billion in FY22-23 of which Apple phones constituted ~50% and Samsung ~40%

- In India retail inflation rates dropped to 5.6% in March’23, lowest in 15 months. In US inflation fell to 5% in March, its lowest since May’21 and in Eurozone to 6.9% as compared to 8.5% in Feb’23

- Manufacturing PMI in Apr’23 was at 57.2 reaching a 4-month high (compared to 56.4 in Mar’22); PMI value above 50 indicates growth

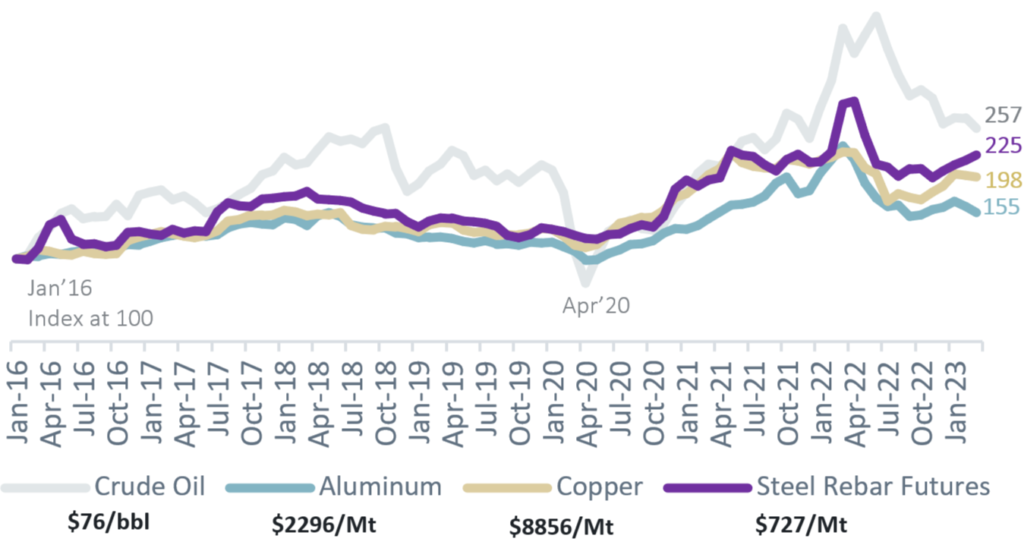

- Oil prices rose sharply as OPEC+ announced a cut in production – Brent Crude prices moved up from ~US 70/bbl in mid-March to ~US$ 85 /bbl before settling down in the US$ 75/bbl range

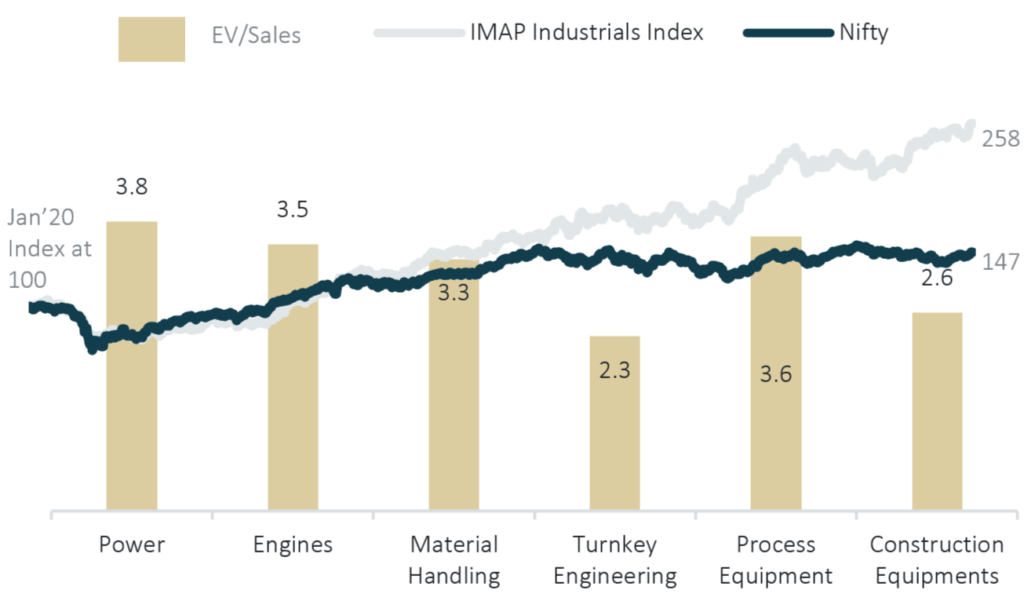

IMAP Industrials Index & Valuation of sub-segments

Commodity Prices Index

IMAP – International M&A Partners is an independent organization focused purely on M&A and transaction success. With over 450 M&A professionals based in over 43 countries, we work together in seamless cross-border sector teams and address each assignment with talent and dedication. We advise primarily mid-sized companies and their shareholders on the sale and acquisition of companies on a global scale.

Reach out to us to discuss more :

- Praveen Nair : +91-9820330033 / praveen@imapindia.in

- Puneet Kochar : +91-9810287367 / puneet@imapindia.in

- Ranga Prasad: +91-9885122544 / ranga@imapindia.in