Industrial Update – Newsletter – Mar 2023: IMAP’s Industrials group brings you this monthly update with a focus on latest news, transactions and interesting snippets from the Industrials domain in India

Using Technology for Predictive Maintenance

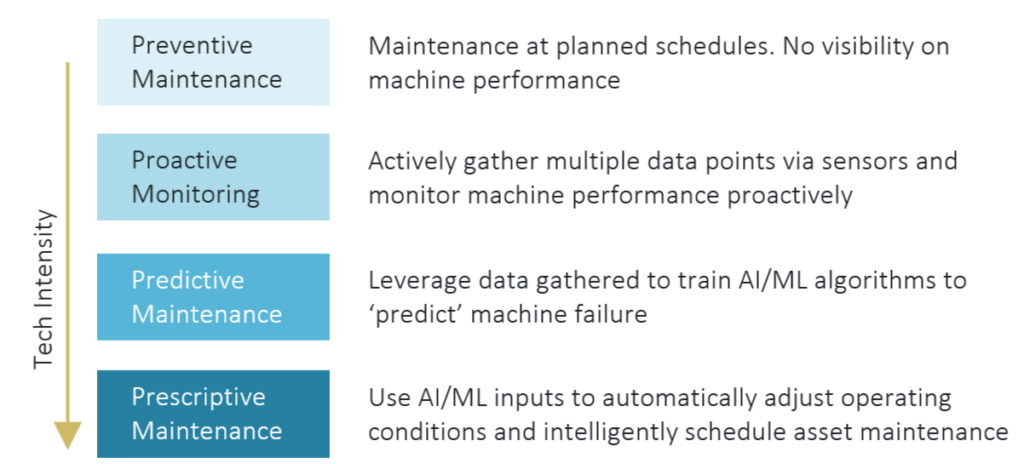

Production units globally are turning to technologies that can help take intelligent decisions to reduce unplanned downtime, increase machine life and help reduce costs. These technologies offer working solutions with quantifiable ROI. The culture of machine maintenance has shifted:

It is estimated that adoption of tech-lead maintenance can help save

~1.6 Mn Hours of unplanned downtime globally

~$970 Bn potential global annual savings via productivity increase and reduction in maintenance costs

How it works?

Sensors in the plant monitor machine parameters – vibration, temperature, humidity, flow, proximity, energy usage etc, and relay information. Using machine learning algorithms and other advanced technologies it then identifies patterns and anomalies to standard patterns. This data is then analyzed to predict when maintenance should be performed, and to identify the root causes of any problems that do occur.

Key players in this space

Some recent transactions

| Mar’23 | J.K. Tyers | International Finance Corporation invested ₹240 Cr. for a 5.60% stake in the company. |

| Mar’23 | Tecso Charge Zone | ₹66 Cr. fundraise led by Blue Orchard Investments |

| Mar’23 | Lotus Surgical | Tube Investments of India acquired 100%of the business for ₹347 Cr. |

| Mar’23 | Greenko Energy | ₹5760 Cr. fundraise led by GIC Singapore, Orix Corporation & others. |

| Mar’23 | Sigtuple Technologies | ₹34.5 Cr fund-raise led by Endiya Partners and Accel India |

| Mar’23 | Kabira Mobility | ₹412.6 Cr. raised in funds from Al-Abdulla Group |

Recent News

- L&T has entered into a manufacturing agreement for electrolyser (a key component for production of green H2) with McPhy Energy, a leading French electrolyser technology and manufacturing company

- In a span of 2 weeks, we witnessed the failure of Silicon Valley Bank (now taken over by First Citizens Bank), Signature Bank (now sold to New York Bancorp) and Credit Suisse (taken over by UBS); central banks will find it increasingly challenging to balance between fighting inflation and protecting banking system from higher interest rates

- Manufacturing PMI in Feb’23 was at 55.3 (55.4 in Jan’23) – indicating 20th month of expansion; PMI value above 50 indicates growth

- GoI allocated a total capacity of 39 GW of domestic solar PV module manufacturing capacity to 11 firms; the total outlay under PLI Scheme is of Rs 14,007 crore

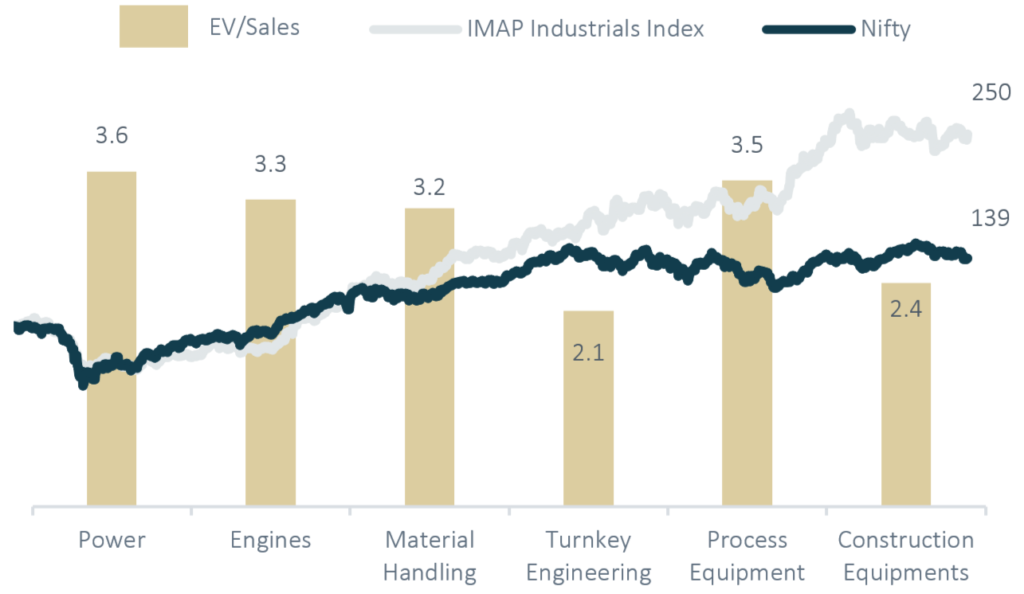

IMAP Industrials Index & Valuation of sub-segments

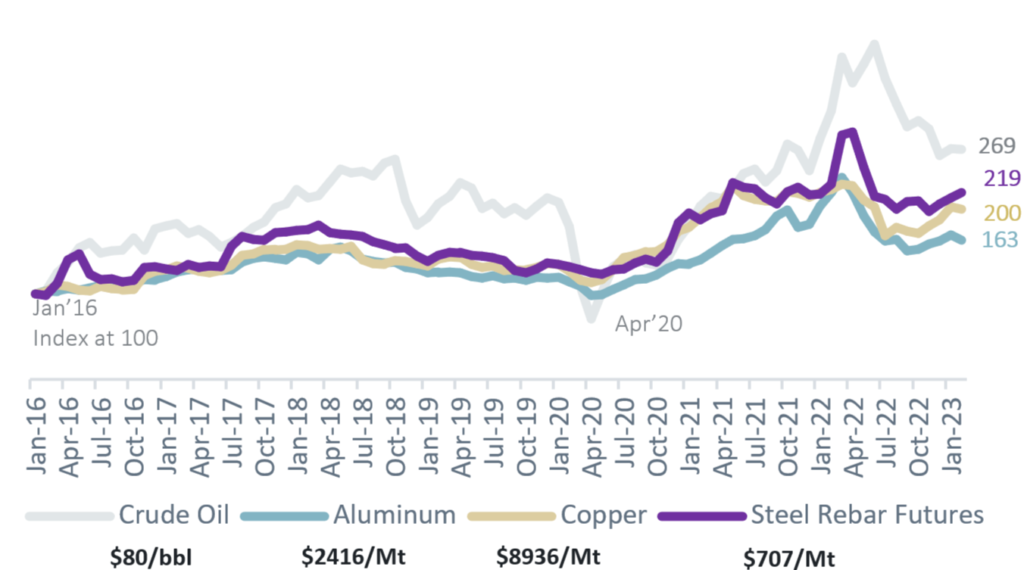

Commodity Prices Index

IMAP – International M&A Partners is an independent organization focused purely on M&A and transaction success. With over 450 M&A professionals based in over 43 countries, we work together in seamless cross-border sector teams and address each assignment with talent and dedication. We advise primarily mid-sized companies and their shareholders on the sale and acquisition of companies on a global scale.

Reach out to us to discuss more :

- Praveen Nair : +91-9820330033 / praveen@imapindia.in

- Puneet Kochar : +91-9810287367 / puneet@imapindia.in

- Ranga Prasad: +91-9885122544 / ranga@imapindia.in